What is GIC Laddering?

GIC laddering is an investment strategy that involves dividing a total investment across multiple Guaranteed Investment Certificates with staggered maturity dates. Instead of locking all funds into a single term, the investment is spread across several terms—typically one through five years. This approach balances the pursuit of higher returns with regular access to funds and protection against interest rate fluctuations. When people refer to “GIC laddering,” they typically mean a rolling ladder strategy, where maturing GICs are continuously reinvested into new long-term GICs.

How It Works

Rather than investing a lump sum into one GIC, the total amount is split into equal portions and allocated to GICs with different terms. As each GIC matures, the proceeds are reinvested into a new GIC, maintaining the ladder structure.

There are two common approaches to laddering:

Rolling Ladder

With a rolling ladder, each maturing GIC is reinvested into a new 5-year term. This creates a perpetual cycle where one GIC matures every year, but funds remain continuously invested at long-term rates.

| Year | What Matures | Action |

|---|---|---|

| 1 | 1-year GIC | Reinvest into a new 5-year GIC |

| 2 | 2-year GIC | Reinvest into a new 5-year GIC |

| 3 | 3-year GIC | Reinvest into a new 5-year GIC |

| 4 | 4-year GIC | Reinvest into a new 5-year GIC |

| 5 | Original 5-year GIC | Reinvest into a new 5-year GIC |

After the initial setup period, the entire portfolio consists of 5-year GICs, but a portion of funds becomes accessible annually.

After the initial 5-year setup period, a rolling GIC ladder creates a perpetual cycle that provides the best of both worlds: the entire portfolio earns 5-year interest rates, while 20% of funds become accessible every year, allowing them to be reinvested at prevailing rates.

Fixed-Term Ladder

With a fixed-term ladder, maturing GICs are reinvested so that all funds become available at the same target date. This approach is useful when planning for a specific future expense.

| Year | What Matures | Action |

|---|---|---|

| 1 | 1-year GIC | Reinvest into a 4-year GIC |

| 2 | 2-year GIC | Reinvest into a 3-year GIC |

| 3 | 3-year GIC | Reinvest into a 2-year GIC |

| 4 | 4-year GIC | Reinvest into a 1-year GIC |

| 5 | All GICs | Withdraw—all funds now available |

Example: $10,000 Invested in a GIC Ladder

To illustrate, consider $10,000 divided into five equal portions of $2,000 each (using hypothetical rates for illustration):

- 1-year GIC at 3.65%

- 2-year GIC at 3.75%

- 3-year GIC at 3.80%

- 4-year GIC at 3.75%

- 5-year GIC at 3.85%

For comparison, assume a single 5-year redeemable GIC offers 3.00%, while a 5-year non-redeemable GIC offers 3.85%.

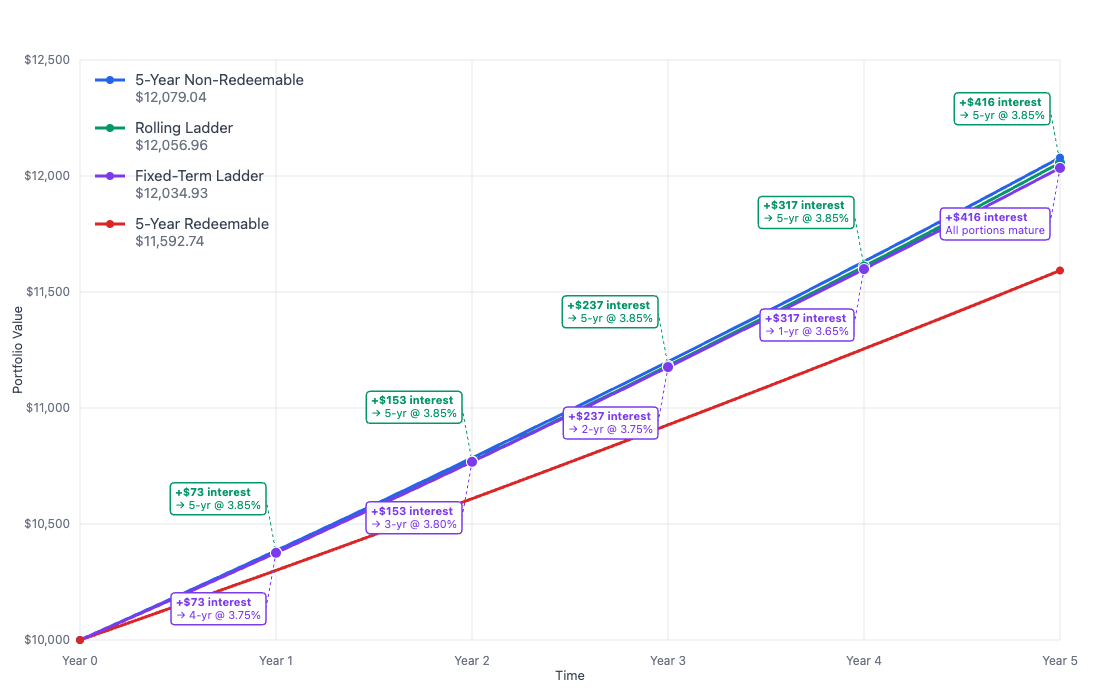

The chart above compares four investment strategies over five years. This example assumes rates remain unchanged when reinvestment occurs. The list below shows the investment values after 5 years. In the rolling ladder strategy, only about 1/5th of this would be accessible at the 5-year anniversary.

- 5-Year Non-Redeemable Highest return ($12,079.04) but funds are locked for the full term

- Rolling Ladder Strong return ($12,056.96) with annual access to maturing portions and continuous 5-year rate capture

- Fixed-Term Ladder Competitive return ($12,034.93) with all funds available at year 5

- 5-Year Redeemable Lowest return ($11,592.74) but offers early withdrawal flexibility

Key Benefits

- Access to Longer-Term Rates Longer-term GICs typically offer better interest rates than shorter-term ones. Both laddering strategies provide access to these higher rates while maintaining liquidity—rolling ladders by reinvesting into 5-year terms, and fixed-term ladders by spreading investments across multiple terms during the accumulation period.

- Consistent Income Rolling ladders provide a steady stream of income as GICs mature annually. This regular access to funds can be particularly useful for retirees or those who need periodic cash flow while keeping the majority of their investment earning long-term rates.

- Flexible Liquidity Options Rolling ladders provide annual access to maturing portions without early withdrawal penalties. Fixed-term ladders concentrate liquidity at a target date, making them ideal for planned expenses. Both approaches avoid locking the entire investment in a single non-redeemable GIC.

- Interest Rate Risk Mitigation Laddering provides protection from rate fluctuations through “averaging in”—by reinvesting at regular intervals, the portfolio captures a blend of rates over time rather than being locked into a single rate. If rates rise, maturing GICs benefit from the new higher rates. If rates fall, only a portion of the portfolio is affected while the rest continues earning previously locked-in rates.

Limitations

- Rate Uncertainty Future GIC rates are unpredictable. When GICs mature, prevailing rates may be lower than what was originally locked in, reducing expected returns on reinvestment.

- Complexity Managing multiple GICs across different terms requires more oversight than a single investment. Additionally, the best rates for each term may be offered by different financial institutions, requiring accounts at multiple institutions to optimize returns.

Tax Considerations

In non-registered accounts, interest on long-term GICs (terms over one year) is typically taxable annually on an accrual basis, even if the interest compounds and is not paid out until maturity. This means the investor may owe tax on interest not yet received in cash.

A GIC ladder strategy helps manage this tax liability. Because a portion of the ladder matures every year, it generates actual cash flow that can be used to pay the tax bill on the accrued interest of the entire portfolio. In contrast, a single 5-year compounding GIC creates an annual tax obligation without providing any liquidity to pay it.

For more information on reporting interest income, refer to the Canada Revenue Agency (CRA) guidelines .

Quick Comparison

| Feature | Single 5-Year GIC | Single 5-Year Redeemable GIC | GIC Ladder |

|---|---|---|---|

| Liquidity | Locked for 5 years | Withdraw at any time | Annual access to maturing portion |

| Interest Rate Risk | High (locked at one rate) | Low (can exit and reinvest) | Mitigated (blended rates over time) |

| Return Potential | Single fixed rate | Lower rate (trade-off for flexibility) | Weighted average of multiple rates |

| Complexity | Simple (one GIC) | Simple (one GIC) | Moderate (multiple GICs to track) |

GIC laddering is one of several approaches to fixed-income investing. Whether it makes sense depends on individual liquidity needs, rate expectations, and willingness to manage multiple investments. For those who prioritize simplicity, a single GIC—cashable or non-redeemable—may be equally effective.