What is an Iron Condor?

An Iron Condor is an advanced options trading strategy designed to profit when an underlying asset trades within a defined price range. An iron condor combines both sides of the options chain: it is built from a bear call spread on the upside and a bull put spread on the downside. This market-neutral, limited-risk, limited-reward structure is a volatility-based strategy that benefits from time decay.

Structure of an Iron Condor

An iron condor consists of four option contracts with the same expiration date. It is typically executed as a single “complex order” to ensure all legs are filled simultaneously at a fixed net credit. It is constructed by combining a bear call spread and a bull put spread:

- Write a call slightly out of the money

- Buy a call with an even higher strike price to limit risk

- Write a put slightly out of the money

- Buy a put with an even lower strike price to limit risk

Typically, the short put and short call are out of the money, meaning the stock price is between them. The long (purchased) options are further out of the money and limit the positions risk.

This creates a “profit zone” between the short strikes (written/sold calls). If the stock price stays within this range at expiration, the investor keeps the full premium received.

Formulas

- Maximum Profit = Net Credit Received

- Maximum Loss = Width of the Wings (Strike Distance) - Net Credit Received

- Upper Breakeven = Short Call Strike + Net Credit

- Lower Breakeven = Short Put Strike - Net Credit

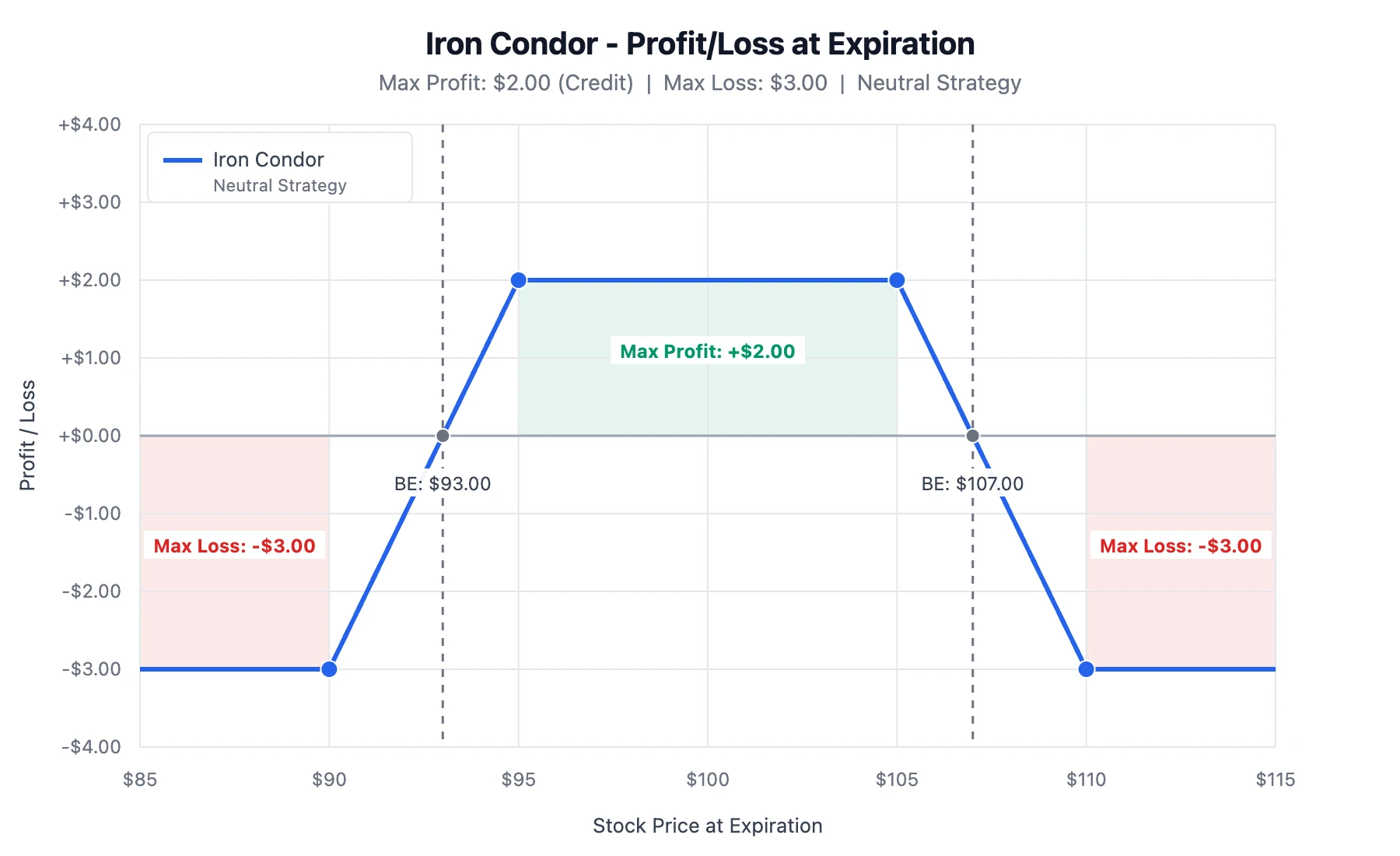

Example

Consider a stock trading at $100. An investor could setup an iron condor by

- Writing a Bull Put spread by selling a $95 Put and Buying a $90 Put

- Writing a Bear Call spread by selling a $105 Call and Buying a $110 Call

The net credit received is $2.00, making the maximum profit $2.00. This occurs if the stock stays between $95 and $105. The maximum loss is $3.00 (difference in strikes minus credit), this will occur if the stock drops below $90 or rises above $110. The breakeven points are $93.00 and $107.00.

How Iron Condors Work

Iron condors profit from time decay (theta) and minimal volatility. The trader collects a premium when opening the position. If the stock remains between the two short strikes at expiration, all options expire worthless and the trader keeps the premium.

This setup can be attractive when implied volatility (IV) is elevated and expected to decline, or when the investor expects realized volatility to stay below IV. Elevated IV lets the investor collect more premium, but it also implies larger potential price swings; a rise in IV after entry will generally hurt an iron condor.

Note on Volatility Skew: In equity markets, puts often trade at a higher implied volatility than calls (skew). This means the put side of the condor may generate more premium than the call side for the same distance from the money, or traders might set the put strikes further away to balance the delta.

Strike Selection

Selecting the right strike prices is a balance between risk and reward. The further out-of-the-money the short strikes are, the higher the probability of profit, but the lower the premium received.

- Delta – An investor aiming for roughly an 80-85% probability that the short options expire out of the money will typically sell the 15 to 20 delta options for the short strikes. Delta is the options Greek often used to approximate this probability of profit.

- Technical Analysis – Traders often look for support and resistance levels on a chart. Ideally, the short put is placed below a key support level, and the short call is placed above a key resistance level, adding a technical buffer to the statistical probability.

- Width of the Wings – The distance between the short and long strikes determines the capital requirement and maximum risk. Wider wings increase the credit received (and max loss) but do not change the probability of success, whereas narrower wings reduce risk but also reduce the potential return.

Greeks at a Glance

- Delta ≈ 0 (can skew based on strike selection)

- Theta > 0 (time decay works in the investors favor)

- Vega < 0 (rising IV hurts)

- Gamma < 0 (sharp moves are adverse to P/L)

Benefits of Iron Condors

- Good Probability of Profit – Profits if price stays in range

- Defined Risk and Reward – Losses and gains are capped

- Time Decay Works in the Investors Favor

- Flexible Strike Selection allows investor to adjust risk tolerance

- Capital Efficiency – While the investor receives a credit upfront, this amount acts as an offset to the margin requirement. The buying power reduction is typically the width of the wings minus the credit received, which is often less than the capital required for directional stock trades.

Risks and Considerations

- Limited Profit – the investor keeps only the premium received

- Losses Can Happen Quickly if price moves sharply

- Assignment Risk – If a short option is assigned early (common with dividends or deep ITM moves), the position transforms into long or short stock. This dramatically changes the risk profile and margin requirements.

- Volatility expansion (IV rising) can hurt position value, even if price stays between the short strikes.

- Commission Costs – Because an iron condor involves four distinct option legs, commission costs can be significant. Opening and closing the trade requires 8 total contracts per 1 condor, which can eat into potential profits.

- Pin risk near expiration if the underlying settles very close to a short strike.

- High-probability trade-offs – setups with far OTM shorts typically have smaller maximum profit than maximum loss unless IV is very elevated or strikes are set closer to the money.

Variations

Iron Butterfly

While an iron condor uses out-of-the-money strikes for the short options, an Iron Butterfly uses the same strike price for both the short call and the short put (typically at-the-money).

- Iron Condor: Lower max profit, higher probability of profit (wider profit zone).

- Iron Butterfly: Higher max profit, lower probability of profit (narrower profit zone).

Other Condors (Call Condor & Put Condor)

A standard Condor strategy achieves a similar payoff profile to the Iron Condor but uses only one type of option (all calls or all puts).

- Call Condor: Constructed using four call options. It involves buying a deep ITM call, selling an ITM call, selling an OTM call, and buying a further OTM call.

- Put Condor: Constructed using four put options. It involves buying a deep OTM put, selling an OTM put, selling an ITM put, and buying a further ITM put.

Unlike the Iron Condor, which is a credit spread (you receive money to open), standard condors are typically debit spreads (you pay money to open), though the profit/loss profile at expiration is effectively the same.

Managing the Trade

Active management is usually necessary for iron condors, as losses can compound quickly if the underlying asset makes a strong directional move.

Profit Taking

It is a common practice to close the iron condor early rather than holding to expiration.

- 50% Rule – Many traders set a limit order to buy back the condor when it reaches 50% of the maximum potential profit. This locks in gains and eliminates the “gamma risk” associated with expiration week, where small price moves can drastically swing the position’s P/L.

Defensive Moves

If the stock price approaches one of the short options

- Rolling – The investor can “roll” the position by buying it back and selling a new iron condor with a later expiration date or adjusted strikes. This buys more time for the trade to work but may not always be possible for a credit.

- Rolling the Untested Side – If the stock falls towards the investors put strikes, the call side will usually drop in value. The invetor can close the original bear call spread and sell a new one closer to the current stock price to collect more credit, reducing the overall max loss. However, this reduces the profitability of the investment.

Iron Condor vs. Single Spreads

| Feature | Iron Condor | Bear/Bull Spread |

|---|---|---|

| Market Outlook | Neutral | Directional |

| Position Type | Credit | Credit or Debit |

| Profit Zone | Range-bound | One-sided |

| Max Risk | Limited | Limited |

| Time Decay | Strong benefit | Moderate |

Conclusion

The iron condor is a cornerstone strategy for traders who prefer probability, structure, and consistency over large directional bets. It allows traders to profit from time decay and stable markets, making it a powerful tool during periods of consolidation.

For traders who understand risk management and volatility behavior, the iron condor offers a balanced, disciplined approach to options trading.