What is a Bull Spread?

A bull spread is an options strategy designed to profit from a moderate to large price rise while capping both potential gains and losses. The strategy involves buying one option and selling another of the same type (calls or puts) with the same expiration but different strikes. This structure creates a defined risk-reward profile: profit is limited, but so is risk.

This strategy suits a neutral to moderately bullish outlook. Selling the second option significantly reduces the trade’s cost compared to buying a single option.

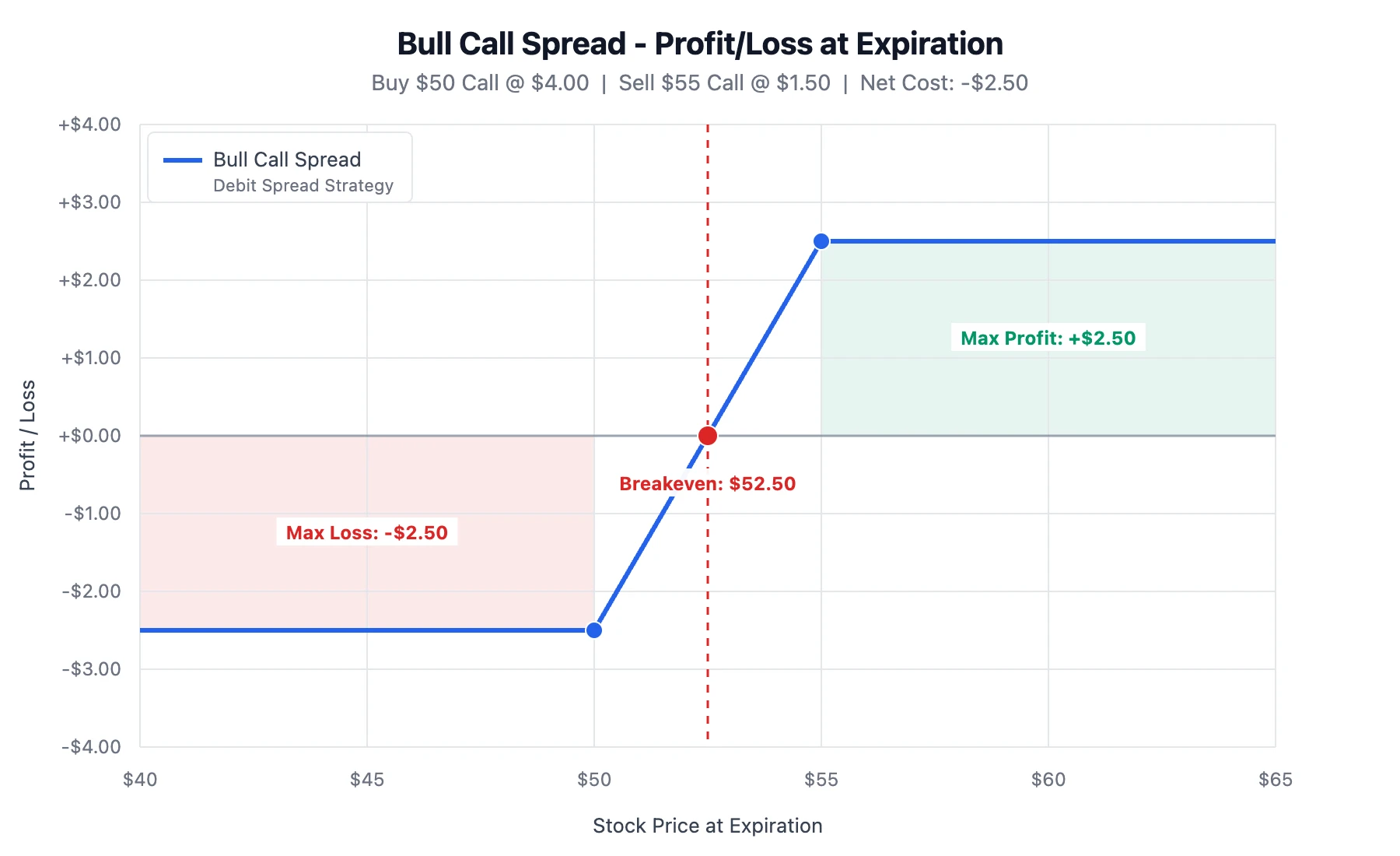

Bull Call Spread (Debit Spread)

A bull call spread involves buying a call at a lower strike and selling a call at a higher strike with the same expiration.

Since the purchased call costs more than the premium received from the sold call, this trade results in a net debit (upfront cost).

Key characteristics:

- Maximum Profit = Strike difference − Net debit

- Maximum Loss = Net debit

- Breakeven = Lower strike + Net debit

Max profit occurs if the asset closes at or above the higher strike. Max loss occurs if it closes at or below the lower strike.

Example

Stock at $50.

- Buy $50 call for $4.00

- Sell $55 call for $1.50

- Net Debit = $2.50

| Outcome | Calculation | Result |

|---|---|---|

| Max Profit | ($55 − $50) − $2.50 | $2.50 |

| Max Loss | $2.50 (net debit) | $2.50 |

| Breakeven | $50 + $2.50 | $52.50 |

If the stock closes above $55, the investor makes $2.50. If below $50, the investor loses the $2.50 debit.

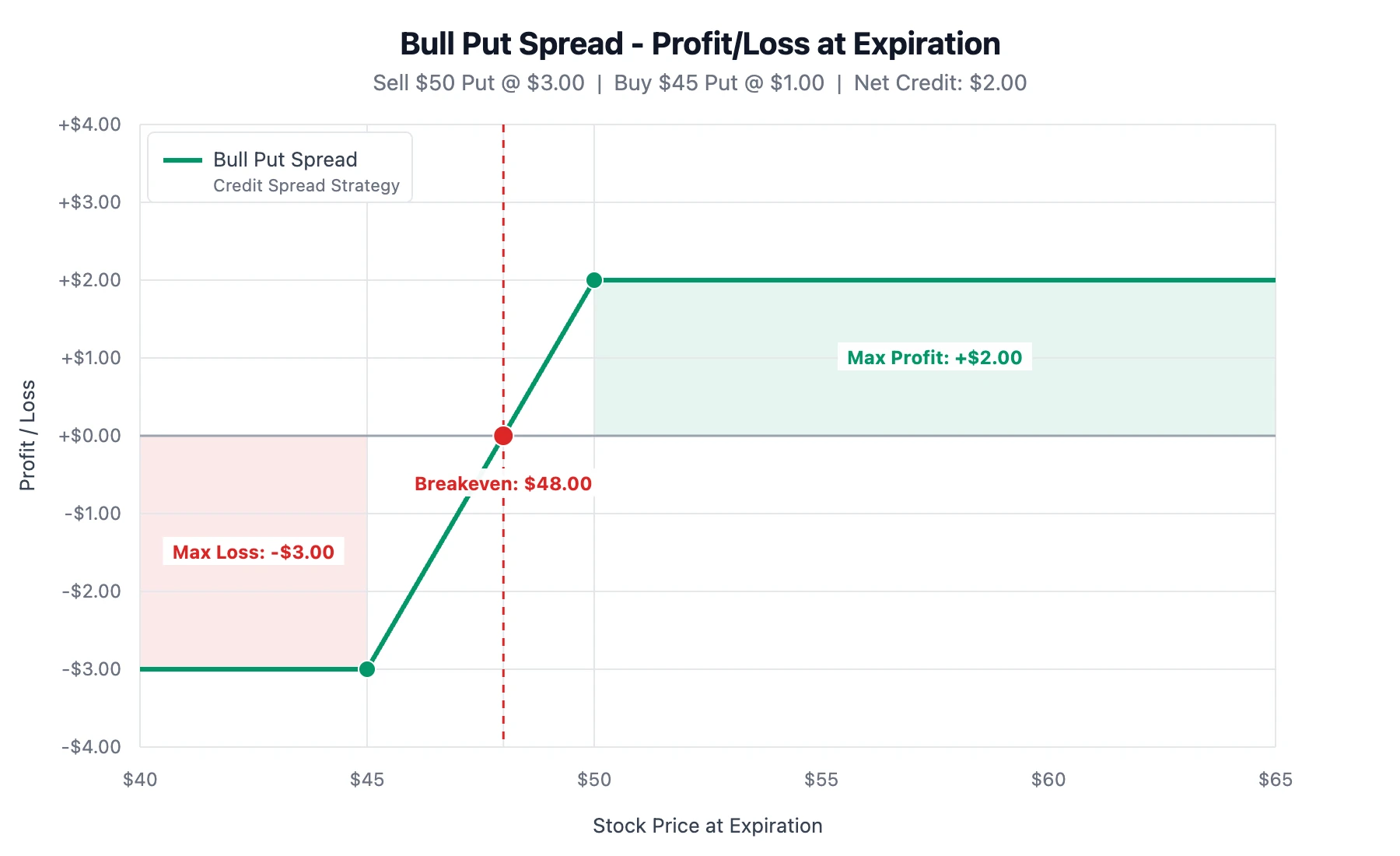

Bull Put Spread (Credit Spread)

A bull put spread involves selling a put at a higher strike and buying a put at a lower strike with the same expiration.

Since the sold put generates more premium than the cost of the purchased put, this trade results in a net credit (upfront income).

Key characteristics:

- Maximum Profit = Net credit

- Maximum Loss = Strike difference − Net credit

- Breakeven = Higher strike − Net credit

Max profit occurs if the asset closes at or above the higher strike. Max loss occurs if it closes at or below the lower strike.

Example

Stock at $50.

- Sell $50 put for $3.00

- Buy $45 put for $1.00

- Net Credit = $2.00

| Outcome | Calculation | Result |

|---|---|---|

| Max Profit | $2.00 (net credit) | $2.00 |

| Max Loss | ($50 − $45) − $2.00 | $3.00 |

| Breakeven | $50 − $2.00 | $48.00 |

If the stock closes above $50, the investor keeps the $2.00 credit. If below $45, the investor loses the max $3.00.

Upfront Credit

The net credit is received immediately and can be invested to generate additional returns during the trade’s life.

Spread Width Considerations

The “width” (distance between strikes) affects risk and reward:

- Wider spreads: Higher max profit, higher max loss.

- Narrower spreads: Lower max profit, lower max loss.

Time Decay (Theta)

Bull Call (Debit): Time decay generally hurts. Since the position is paid for upfront, the stock needs to move up before time runs out.

Bull Put (Credit): Time decay generally helps. Since a credit was received, the position profits as the options lose value over time, provided the stock stays steady or rises.

Closing Early

The position does not need to be held until expiration. To close the entire position, the investor executes the reverse of the opening trade: buying back the short option and selling the long option.

- Take Profits: Close the spread if the stock moves favorably early.

- Cut Losses: Close the spread if the stock drops to limit further loss.

- Legging Out: The investor can also choose to close only one leg. For instance, buying back the short call in a bull call spread removes the profit cap, making the upside potential theoretically infinite.

Risks

Early Exercise Risk

Most US equity options are American-style. If the counterparty exercises the short option early, the trader will be assigned—forcing them to buy or sell shares at the strike price. This creates an unexpected stock position (short or long) and a potential margin call. If the market moves against this new stock position before the long option can be exercised to cover it, losses can exceed the spread’s theoretical maximum.

Early exercise is most likely when the short option is deep in-the-money or a dividend is approaching.

Pin Risk

Pin risk occurs when the stock closes near the short strike at expiration. The investor may not know if they have been assigned until the next trading day. If assigned unexpectedly while the long hedge expires worthless, the trader could end up in an unhedged stock position.

Partial Fill Risk

Since spreads involve two legs, one might fill while the other doesn’t (or fills at a bad price), leaving the trader with a naked option position. Using “spread orders” ensures both legs fill simultaneously.

Bull Call vs. Bull Put

| Factor | Bull Call Spread | Bull Put Spread |

|---|---|---|

| Type | Debit spread | Credit spread |

| Cash Flow | Pay upfront | Receive upfront |

| Max Profit | Strike diff − Debit | Credit received |

| Max Loss | Debit paid | Strike diff − Credit |

| Theta | Hurts position | Helps position |

| Best When | Expecting move up | Expecting stability/move up |