What is a Bear Spread?

A bear spread is an options trading strategy designed to profit from a moderate to large decline in the price of an underlying asset. Like other options spreads, a bear spread involves simultaneously buying one option and selling another of the same type (either puts or calls), with the same expiration date but different strike prices. This creates a defined risk/reward profile — both profit and loss potential are capped.

Bear spreads are ideal for traders who believe the underlying asset’s price will fall, but want to limit risk compared to outright shorting or buying put options outright.

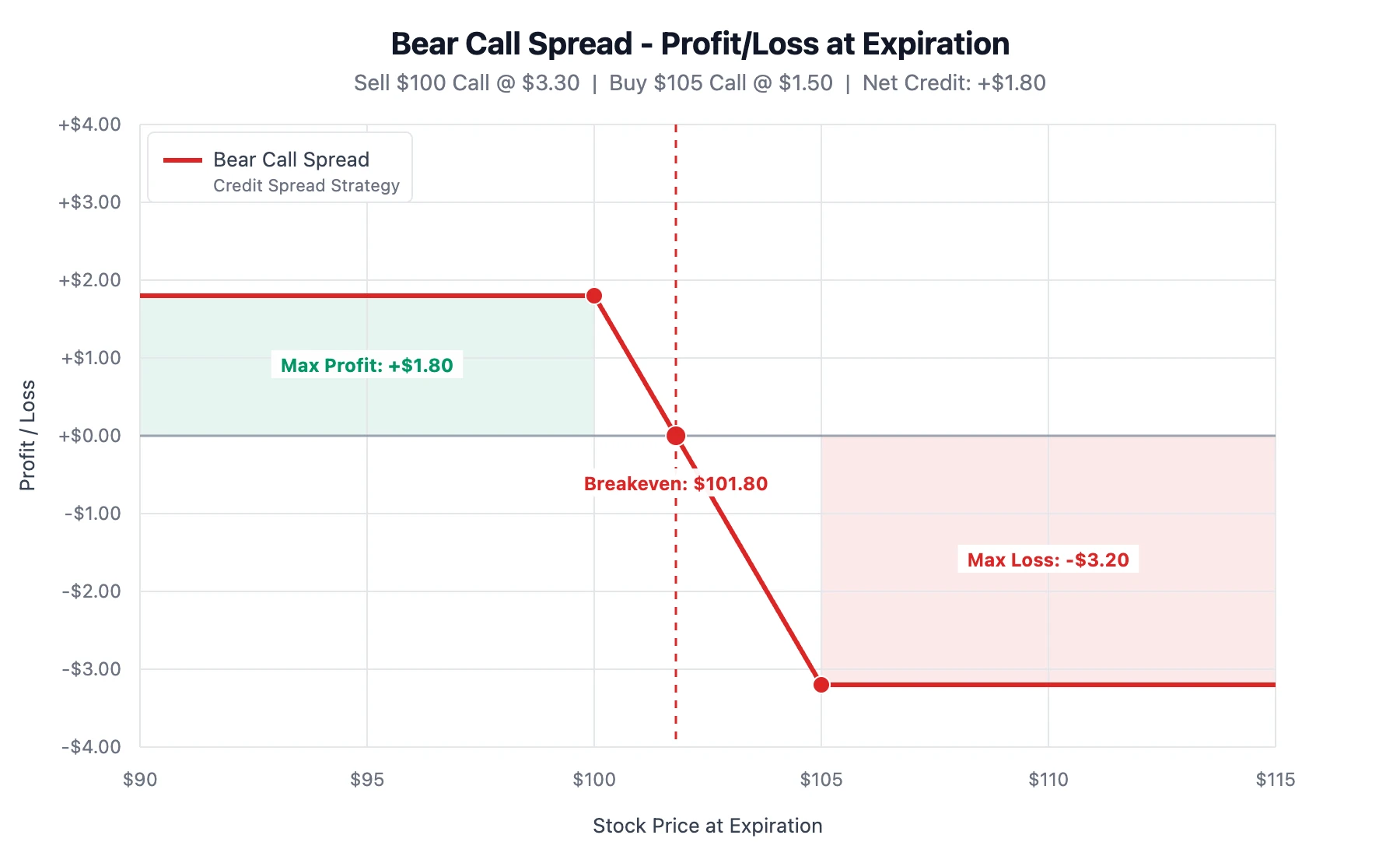

Bear Call Spread (Credit Spread)

A bear call spread (also known as a bear call credit spread) is created by selling a call option with a lower strike price and buying a call option with a higher strike price with the same expiration date.

Since the sold call (lower strike) commands a higher premium than the purchased call (higher strike), this trade generates a net credit (upfront cash received).

Key characteristics

- Maximum Profit = Net credit received

- Maximum Loss = Difference in strikes − Net credit

- Breakeven = Lower strike + Net credit

Max profit is achieved if the stock price is at or below the lower strike at expiration. However, the trade remains profitable as long as the stock price stays below the breakeven point.

Example

Assume XYZ stock is at $100:

- Sell 1 XYZ $100 call for $3.30

- Buy 1 XYZ $105 call for $1.50

- Net Credit = $3.30 − $1.50 = $1.80

| Outcome | Calculation | Result |

|---|---|---|

| Max Profit | $1.80 (net credit) | $1.80 |

| Max Loss | ($105 − $100) − $1.80 | $3.20 |

| Breakeven | $100 + $1.80 | $101.80 |

If the stock closes at or below $100, the investor keeps the full $1.80. If it closes at $101, the investor still makes a profit ($101.80 - $101.00 = $0.80 profit).

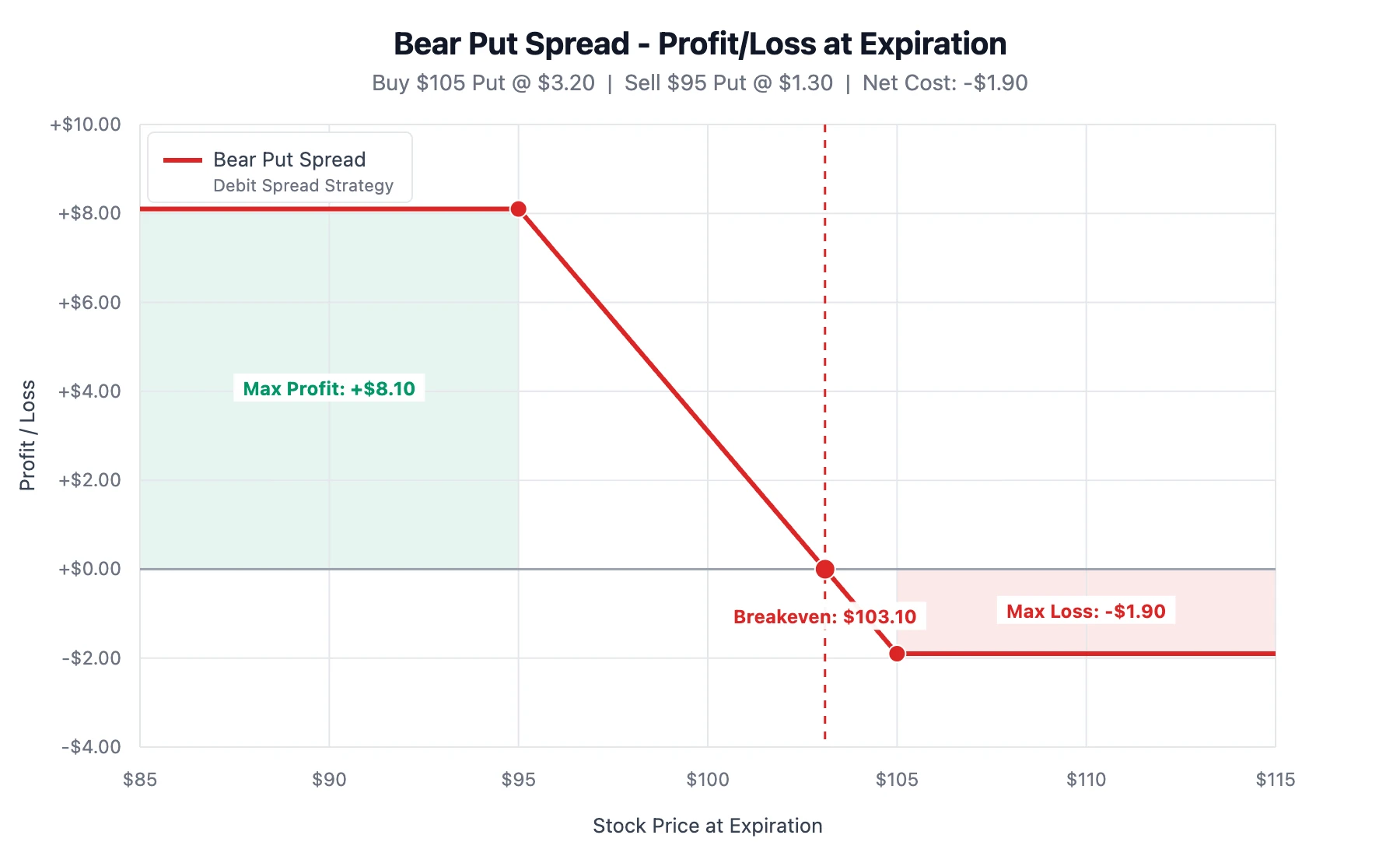

Bear Put Spread (Debit Spread)

A bear put spread involves buying a put option with a higher strike price and selling a put option with a lower strike price with the same expiration date.

Since the purchased put (higher strike) costs more than the premium received from the sold put (lower strike), this trade results in a net debit (upfront cost).

Key characteristics

- Maximum Profit = Difference in strikes − Net debit

- Maximum Loss = Net debit paid

- Breakeven = Higher strike − Net debit

Max profit occurs if the stock closes at or below the lower strike price at expiration. However, the trade is profitable as long as the stock closes below the breakeven point.

Example

Suppose XYZ stock is trading at $100:

- Buy 1 XYZ $105 put for $3.20

- Sell 1 XYZ $95 put for $1.30

- Net Debit = $3.20 − $1.30 = $1.90

| Outcome | Calculation | Result |

|---|---|---|

| Max Profit | ($105 − $95) − $1.90 | $8.10 |

| Max Loss | $1.90 (net debit) | $1.90 |

| Breakeven | $105 − $1.90 | $103.10 |

If the stock closes at or below $95, the maximum profit of $8.10 is achieved. If it closes at $100, the trade is still profitable ($103.10 - $100 = $3.10 profit).

Spread Width Considerations

The “width” (distance between strikes) affects risk and reward:

- Wider spreads: Higher potential profit (for put spreads) or credit (for call spreads), but higher risk.

- Narrower spreads: Lower potential profit/credit, but lower risk.

Time Decay (Theta)

Bear Call (Credit): Time decay generally helps. Since the position is a net credit, the trader benefits as the options lose value over time, provided the stock stays below the strikes.

Bear Put (Debit): Time decay generally hurts. Since the position is paid for upfront, the stock needs to drop fast enough to overcome the loss of time value.

Closing Early

The position does not need to be held until expiration. To close the entire position, the investor executes the reverse of the opening trade: buying back the short option and selling the long option.

- Take Profits: Close the spread if the stock moves favorably early.

- Cut Losses: Close the spread if the stock rises to limit further loss.

- Legging Out: The investor can also choose to close only one leg. For instance, buying back the short put in a bear put spread removes the profit cap, allowing for greater gains if the stock continues to fall.

Risks

Early Exercise Risk

American-style options allow the holder to exercise their right to buy or sell the underlying asset at any time before expiration. If an investor is short an American-style option, they face the risk of early assignment. This is most common if the short option is deep in-the-money. Early assignment converts the option position into a stock position (long or short), which can significantly alter the risk profile and margin requirements. Additionally, early assignment might make it difficult for the investor to exercise their purchased option to limit their loss.

Pin Risk

Pin risk occurs when the stock closes exactly at or very near the short strike price at expiration. It may not be known for certain if assignment will occur until the next trading day. This creates uncertainty and potential for unexpected overnight risk if the stock moves significantly before the investor can react.

Partial Fill Risk

Because spreads involve two different legs (buying one option and selling another), there is a risk that one leg executes while the other does not, or they execute at significantly different prices than intended. This is often called “leg risk.”

Bear Put vs. Bear Call

| Feature | Bear Put Spread | Bear Call Spread |

|---|---|---|

| Type | Debit spread | Credit spread |

| Cash Flow | Pay upfront | Receive upfront |

| Max Profit | Strike diff − Debit | Credit received |

| Max Loss | Debit paid | Strike diff − Credit |

| Theta | Hurts position | Helps position |

Both strategies serve bearish market views but differ in cash flow and ideal conditions. Bear call spreads are often preferred when implied volatility is high (to sell expensive premium), while bear put spreads may be better when volatility is low.