How Are GIC Returns Taxed in Canada

GIC interest earned in non-registered accounts is taxed as regular income—100% of the interest is added to your taxable income for the year. This makes understanding the tax rules important for maximizing after-tax returns.

The good news: GICs held in registered accounts like TFSAs, RRSPs, and FHSAs are either tax-free or tax-deferred, meaning you don’t need to report this income on your tax return.

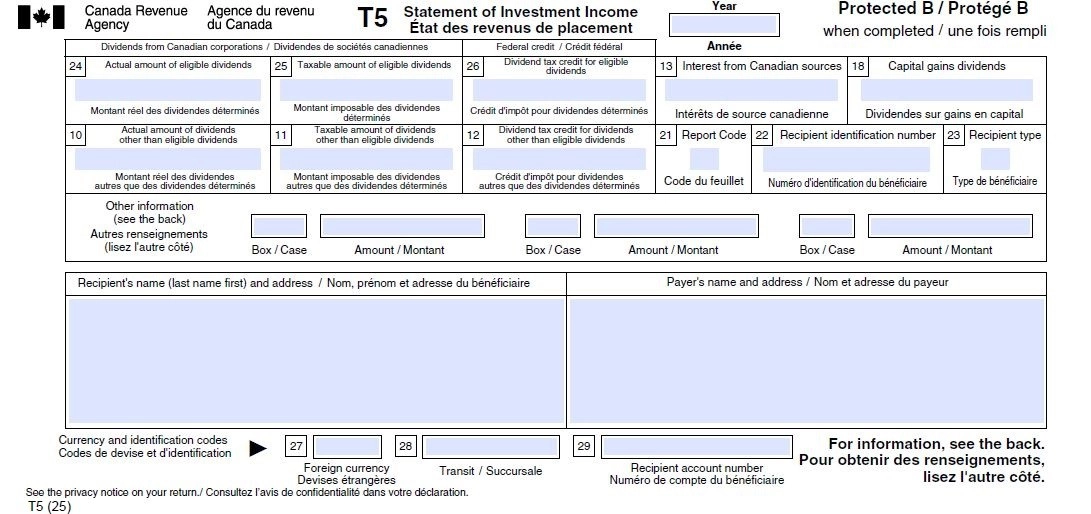

The T5 Slip

When you earn investment income from a GIC in a non-registered account, your financial institution will issue a T5 Statement of Investment Income slip. This slip reports the interest you earned during the calendar year.

The key box for GIC investors is Box 13 – Interest from Canadian sources. This is where your GIC interest appears. You report this amount on line 12100 of your tax return.

For detailed information on all T5 boxes, see the CRA’s T5 slip guide

The $50 Threshold

Financial institutions are not required to issue a T5 slip if your total interest income from that institution is under $50 for the year.

Even if you don’t receive a T5, you are still required to report the interest income on your tax return.

When Interest Is Taxed: The Accrual Rule

GIC interest is taxed in the year it accrues, not necessarily when you receive it. For most GICs, this means interest is recognized annually on the anniversary date of the investment, even if you can’t access the funds until maturity.

This creates an important tax planning consideration:

A 1-year GIC can be more tax-efficient than multiple shorter-term GICs.

Consider an investor with $10,000 at 4% APR and a 40% marginal tax rate:

| Strategy | Year 1 Interest | Year 1 Tax | Year 2 Interest | Year 2 Tax |

|---|---|---|---|---|

| Two 6-month GICs | $200 | $80 | $200 | $80 |

| One 1-year GIC | $0 | $0 | $400 | $160 |

Both strategies earn the same total interest ($400) and pay the same total tax ($160). However, the 1-year GIC defers an additional $80 in taxes to the following year. If that $80 is invested elsewhere it can earn interest in the interim. This deferral is especially valuable if you expect to be in a lower tax bracket in the following year.

Registered Accounts: Tax-Free Growth

GICs held in registered accounts do not generate T5 slips and do not need to be reported on your tax return:

- TFSA (Tax-Free Savings Account) – Interest grows completely tax-free. Withdrawals are not taxable.

- RRSP (Registered Retirement Savings Plan) – Interest is tax-deferred. You pay tax only when you withdraw funds in retirement.

- FHSA (First Home Savings Account) – Interest grows tax-free and remains tax-free when withdrawn for a qualifying home purchase.

For current contribution limits and top rates, see our guide to Best Canadian GIC Rates in 2026

Market-Linked GIC Taxation

Returns from market-linked GICs (also called equity-linked or index-linked GICs) are taxed as interest income, not capital gains—even though the returns are tied to stock market performance.

This means 100% of your return is taxable at your marginal rate, which is less favourable than capital gains treatment (where only 50% is taxable under the current inclusion rate).

However, most market-linked GICs offer a guaranteed minimum total return (e.g., 2% over 3 years) rather than an annual percentage rate. Because there is no guaranteed annual interest accruing, the tax liability is deferred until maturity when the actual return is determined.

For a detailed breakdown of how these products work, see What are Market Growth GICs?

Foreign Currency GICs

Foreign currency GICs (such as USD GICs) have two tax components:

- Interest Income – Taxed as regular interest income, converted to CAD at the exchange rate on the date received.

- Currency Gains or Losses – If the exchange rate changes between when you purchased the GIC and when it matures, the difference on your principal may be treated as a capital gain or loss.

A Note on Capital Gains

GIC interest is not treated as a capital gain. Unlike stocks or ETFs, GIC interest is always taxed as regular income—100% of the interest is added to your taxable income, making it less tax-efficient than capital gains (which benefit from a lower inclusion rate).

However, some GIC-wrapper ETFs like HSAV (Global X Cash Maximizer Corporate Class ETF) are structured to convert interest income into capital gains for tax purposes. These products use a total return swap structure, meaning gains may be taxed more favourably than holding the underlying GICs directly. This is an advanced strategy with its own considerations and risks.

Summary

| Account Type | Tax Treatment |

|---|---|

| Non-registered | 100% taxable as interest income |

| TFSA | Tax-free |

| RRSP | Tax-deferred until withdrawal |

| FHSA | Tax-free for qualifying home purchases |

For most investors, holding GICs in registered accounts is the most tax-efficient approach. If you must use a non-registered account, consider GICs that pay interest at maturity for the tax deferral.